Financial professionals often come across MAA250. A competent accounting and finance student appreciates ethics. Ethics could be applied to the decisions that a student makes. Ethics play a significant role in the decision-making process. It helps a student to create efficient choices.

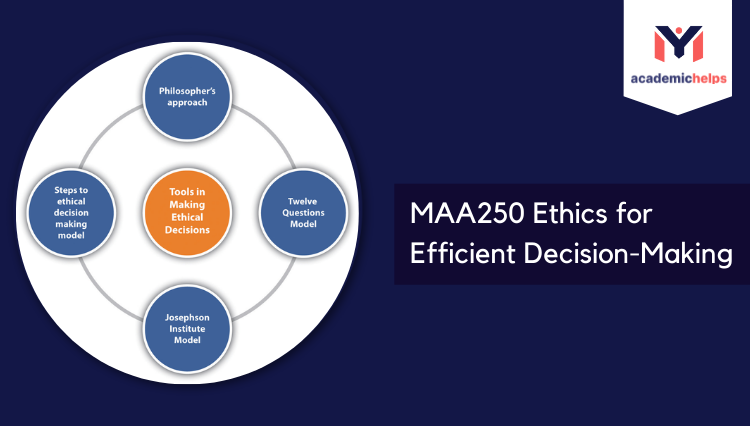

Online Assignment help provides help for the topics like nature of ethics, different ethical factors that influence finance-related services, theoretical notion of ethics, its principles, and a number of ethical decision-making models.

Students often forget to focus on the theoretical aspects while working on practical assessments. Finance assignment help is provided by financial experts that may help students to work on the theoretical aspects of an evaluation. These experts try to be as flawless as they can be. While working on these assignments, these experts make sure that they include key features of MAA250 in each project they are dealing with.

What role does research play in the decision-making process undertaken by the Financial Manager?

Beginning with extensive research, these experts conduct full-fledged research before working on an assignment. The study would help in resolving the prevalent problems of an organization. Financial experts focus on improving the relationship between shareholders and executives of the company. Besides, they emphasize establishing trustworthy third-party relationships.

The second part deals with ethics for financial professionals. Here, they tend to answer the questions related to corporate governance principles.

What are the various Governance Principles under MAA250 Ethics for Financial Professionals?

Several principles fall under MAA250 Ethics for Financial Professionals; Governance Structure, Structure of the Board and its committees, Director’s appointment procedures, Director’s duties, remuneration, performance, Risk governance, internal control, reporting with integrity, and Audit, Relationship with shareholders and other stakeholders.

Students interested in pursuing MAA250 must be well-versed with the concepts and principles, which would help them become proficient in the decision-making process. So, it is essential to know each idea before you undertake the job of a financial expert. Financial Professionals guide the concepts of right and wrong.

What are the Concepts of Right and Wrong?

Many times, people get stuck between right and wrong. Thus, Financial experts will provide you with the right path. You will be provided with how one would decide and undertake actions that are right for the organization. These experts will also provide a roadmap by which you would be able to distinguish between right and wrong.

Whenever you are asked to decide for your organization, you have to consider other people’s interests and the community. Efficient financial managers take a holistic approach and are more likely to avoid wrong decisions.

How does the financial manager predominate the decision-making process?

Whatever a financial manager decides, it directly affects the action or behavior of an organization. The action of a financial manager predominantly affects the organization. The management takes the ethical decision for an organization. This decision must be efficient enough to instill hope and optimism in the workplace so that departments function efficiently. In the end, individual employees have to follow the ethical guidelines and work accordingly.