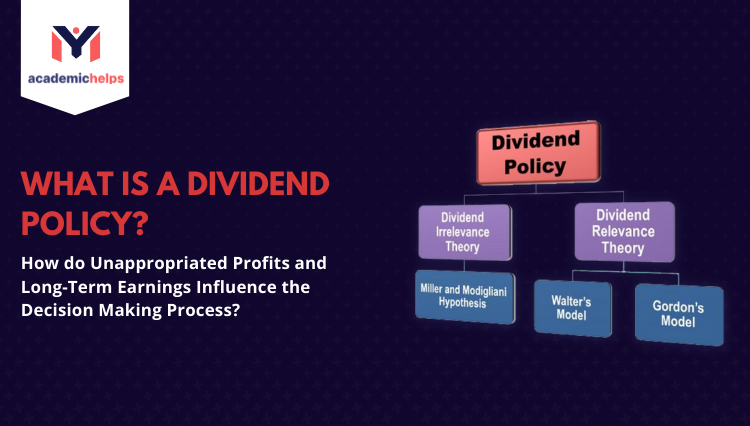

When a company is profitable and has excess cash, the board of directors must decide how to use that money. One option is to pay dividends to all the shareholders. Dividends are payments made by an organization to its stakeholders regularly out of its profits. The dividend policy is the policy that determines how and when those payments will be made. Several factors go into making dividend policy decisions, including the excess profits and the long-term earning power of the business. In this post, we will learn further factors in more detail.

Unappropriated profits are those profits that have not been allocated to specific purposes by the board of directors. They can be used for dividend payments, among other things. The board makes the decision about how to use the profits of directors, and it can be influenced by shareholder pressure or activist investors.

The long-term potential earning of the business is another critical factor in dividend policy decisions. This refers to the capacity of the business to generate incoming profits over a period of time. dividend payments are usually made out of current or past profits, so the board must consider whether the company will be able to continue making profits in order to keep paying

There are three most important approaches to dividends-

Residual

Stability

Hybrid

Residual dividend policy

A residual dividend policy is a dividend payout leftover after investment needs are met. A stability dividend policy payout is a dividend that fluctuates minimally year-over-year, and a hybrid dividend policy is, like the name suggests, a mix of residual and stability.

There are many factors influencing the dividend decision of a company, such as earnings, cash flows, and growth.

Dividend stability policy

A dividend stability policy is a good dividend policy to have in place as it provides dividend certainty for shareholders, which is attractive. A dividend cut is one of the most severe actions a company can take, so dividend stability prevents that from happening.

The best dividend policy is the one that meets the needs of both the company and its shareholders. The payout ratio should be sustainable.

Hybrid dividend policy

A hybrid dividend policy is the best dividend policy as it offers the benefits of both stability and growth.

A dividend policy that is too high may result in the company not being able to reinvest in its future. At the same time, a dividend policy that is too low may send a signal to shareholders that management does not have confidence in the company’s long-term prospects.

Several factors which can influence dividend policy decisions

Several factors which can influence dividend policy decisions are dividend payout ratio, dividend yield, and dividend stability. The dividend payout ratio is a %(percentage) of net income that is given as dividends to its shareholders. In contrast, dividend yield measures how much income a shareholder receives concerning the price they paid for the stock. Dividend stability refers to the ability of a company to maintain its dividend payments even during periods of economic downturn.

Dividend Policy Assignment Help

If you are struggling with your dividend policy assignment, our team of experts at my assignment services can help you. We have a team of dividend policy assignment help experts who are knowledgeable and experienced in this area. Contact us today for more information.

Why Do Students Request Us To Do My Dividend policy Assignment?

There are several reasons why students might need help with Dividend policy assignments. First, the subject matter can be challenging. Second, the assignments may be time-consuming. Third, students may not have access to important resources. Whatever the case, our team of top experts, can assist you.