Taxation has always been the core of any nation’s economy helping government to keep revenue regular and also to grow the economy of a country. But, wait, what is a tax in simple terms? A tax is a monetary burden on individuals for the welfare of the government and the country. Tax is a compulsory contribution and not something voluntary. The government uses tax to carry out social welfare projects like building schools and hospitals, maintaining infrastructure, improving security infrastructure, enforcing law and order in the country, pensions to be distributed among the elderly and people below the poverty line.

Marketing Help targets to provide information on the types of taxes.

What are the most popular types of taxes?

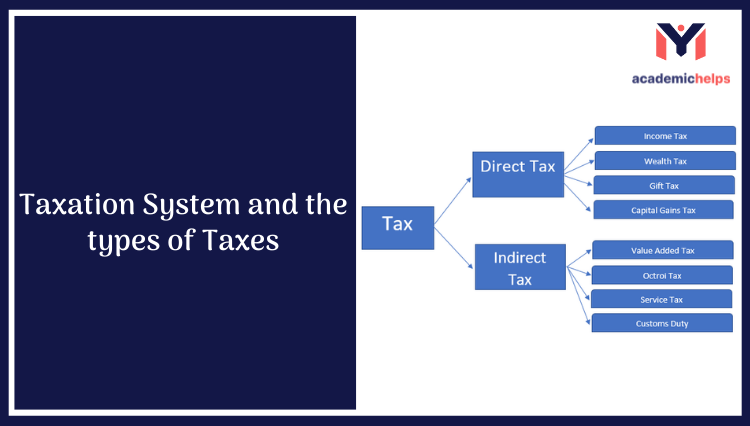

Students often get confused about the types of taxes available in a country. Assignment help gives an insight into the types of taxes available:

- Income Tax

As the name suggests, it is levied on the income of the individuals. Nations follow a progressive income tax system so that higher percentages of taxes could be collected. Marginal tax rates are accountable for the application of income tax. The rate of taxation is decided keeping the length of time in mind.

- Payroll Taxes

Payroll taxes are imposed on both employees and employers and are calculated by viewing the salaries paid to the employees. The Austrian government withholds employment income while calculating payroll taxes.

- Corporate Taxes

These are levied on a company’s income. You can calculate a company’s taxable income by finding sales revenue first then gross profit and finally subtracting interest expense from EBIT and there you go.

- Sales Taxes

Next in the queue, we have sales taxes. As the name suggests, these taxes are charged from customers at the point of sale. Different states may implement their own sales taxes which means they can vary from one location to another.

- Property Taxes

Levied on real estate and tangible personal products like cars and boats. A millage rate plays a crucial role while calculating real estate taxes.

- Tariffs

Tariff is imposed by a country on then goods and services received or imported from another country. Tariff increases the overall price of imported goods and services.

In Australia, Income taxes are the most significant of all. Collected by the federal government via the Australian Taxation Office. The federal government is held responsible for the collection of Australian GST revenue. Besides, Capital Gains Tax (CGT) is also significant in the Australian taxation system. It is applied to any capital gain.

Several other taxes like Fringe Benefits Tax, Inheritance tax, Excise taxes (imposed on cigarettes, petrol, and alcohol), Departure Tax, Trustee liability taxes are also very common in Australia.

A Marketing assignment must form a basis of taxation structure in a country and we hope the purpose is sufficed by the Taxation Law assignment. Lastly, Australia maintains a comparatively lower tax burden in contrast to other wealthy nations and that’s the secret behind the economy of any nation like Australia.